As new tariff deadlines approach, ambiguity surrounds the future of U.S. trade policy. President Donald Trump’s ongoing tariff strategy remains fluid, with some measures already enacted, others postponed, and additional rounds under consideration. While some countries still face steep import taxes, others are negotiating exemptions or adjusting trade terms to avoid economic retaliation. The shifting policy continues to shape market confidence, corporate planning, and global economic relations.

A Broad 10% Tariff Now Covers Most Imports to the U.S.

Since April, the U.S. administration has enforced a minimum 10% tariff on nearly every category of imported goods—with notable exceptions like mobile devices and computers. Products from China, however, continue to be taxed at a higher 30% rate.

According to data from the Bipartisan Policy Center, June saw the government collect nearly $30 billion in tariff revenue, representing a significant increase from just $10 billion in March—prior to the broader application of import taxes. These elevated tariffs have now brought the average U.S. import duty to a level not seen since the Great Depression era.

While foreign exporters absorb a fraction of these costs, the primary burden has fallen on U.S. consumers and businesses, who now face rising prices and supply chain uncertainty.

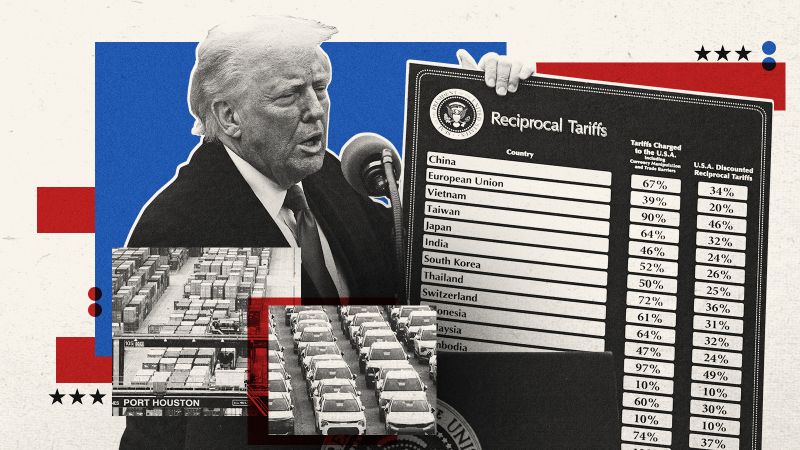

Countries Bracing for Potentially Higher Import Taxes

Several countries that were temporarily spared from elevated tariffs are now confronting renewed threats of steep duties. Initially, U.S. tariffs of up to 24% were imposed on Japanese imports and 49% on Cambodian goods, prompting severe volatility in equity markets. The administration responded by granting a 90-day pause for further negotiations.

That grace period ends this week. The Trump administration has announced plans to restore many of these higher tariffs, largely in alignment with April’s proposals. For instance, new 25% tariffs on imports from Japan and South Korea are currently scheduled to take effect August 1, though the potential for further postponement or adjustments remains.

Economists, including those at Wells Fargo, caution that these delays provide only fleeting relief to business operators and procurement officials. The constant revisions contribute to a broader climate of unpredictability that complicates investment planning and suppresses manufacturing growth.

Trade Policy Volatility Weighs on Manufacturing

A recent Institute for Supply Management report points to a decline in factory orders directly tied to inconsistent trade policy. Manufacturers are grappling with “stop-start” directives that make it difficult to predict raw material costs or customer demand.

This sentiment is echoed by a plant manager who noted that clients have begun to delay major purchases, pending clarity on future pricing. The current tariff framework has created ripple effects across sectors like heavy equipment, textiles, and energy components.

China Faces Steeper Rates After Retaliatory Measures

Imports from China remain under a 30% duty, which is still relatively low compared to the 145% tariffs imposed briefly during previous rounds of tit-for-tat actions. President Trump has criticized Beijing for exporting significantly more goods to the U.S. than it imports and raised concerns over fentanyl trafficking.

Despite the elevated tariffs, some industries continue to rely heavily on Chinese imports due to their volume and cost-effectiveness, which has prompted businesses to explore alternative suppliers in Southeast Asia.

EU Tariffs Under Review as Trade Relations Shift

Trump’s administration had initially announced a 20% tariff on imports from the European Union, later reducing it to 10%. A final rate has not yet been confirmed, but speculation suggests it could climb to 50%, depending on future negotiations.

Although the EU has so far refrained from imposing retaliatory tariffs, increasing trade tension could compel the bloc to introduce countermeasures on American exports, including agricultural products and vehicles.

Mexico and Canada: Tariff Exceptions Under USMCA

Early in the year, Mexico and Canada were among the first to face new tariffs—25% on most goods, and 10% on Canadian energy products. However, those tariffs were partially suspended for items covered by the United States-Mexico-Canada Agreement (USMCA).

That decision was reportedly linked to those countries’ efforts to address illegal immigration and the fentanyl trade, although economic backlash from U.S. investors likely influenced the outcome as well. Still, Mexican and Canadian goods outside the USMCA umbrella remain subject to the 25% duty.

U.K. and Vietnam Have Limited Trade Deals in Place

The United Kingdom and Vietnam have each negotiated limited trade deals that protect a portion of their exports from higher tariffs. The U.K. secured a 10% baseline rate, while Vietnam agreed to a 20% rate, avoiding the earlier threat of tariffs up to 46%.

The shift of manufacturing from China to Vietnam by certain exporters reflects a growing strategy among global producers to navigate the U.S. tariff landscape more effectively.

Special Tariffs Target Steel, Autos, and Aluminum

In a bid to protect strategic industries, Trump has imposed 50% tariffs on imported steel and aluminum, except for imports from the U.K., which are taxed at 25%. Auto imports and related parts are also taxed at 25%, though USMCA-covered items remain exempt.

Additionally, new tariffs apply to certain manufactured goods using raw steel and aluminum to counter the trend where U.S. manufacturers pay more for materials but lose out to cheaper imported finished products.

More Tariffs Under Consideration

The administration is currently evaluating duties on more product categories, including pharmaceuticals, semiconductors, lumber, and copper. These discussions signal the possibility of even broader trade restrictions in the near future.

Legal Challenges Could Alter the Tariff Landscape

Many of these measures were enacted under the International Emergency Economic Powers Act (IEEPA), a 1977 statute. Several states and trade groups have filed lawsuits challenging the administration’s authority to use IEEPA for tariff implementation tied to a long-term trade imbalance.

In May, a specialized federal trade court struck down aspects of the tariffs, although they remain in effect pending appeal. If the court ultimately rules against the application of IEEPA in this context, Trump could still invoke other legal frameworks to target specific imports. The evolution of Trump’s tariff policy continues to disrupt international trade dynamics. While the administration maintains that tariffs are a strategic tool for negotiation and national security, the global response remains cautious. Many U.S. businesses and trade partners now operate in an environment shaped by frequent policy shifts and high-stakes economic diplomacy.