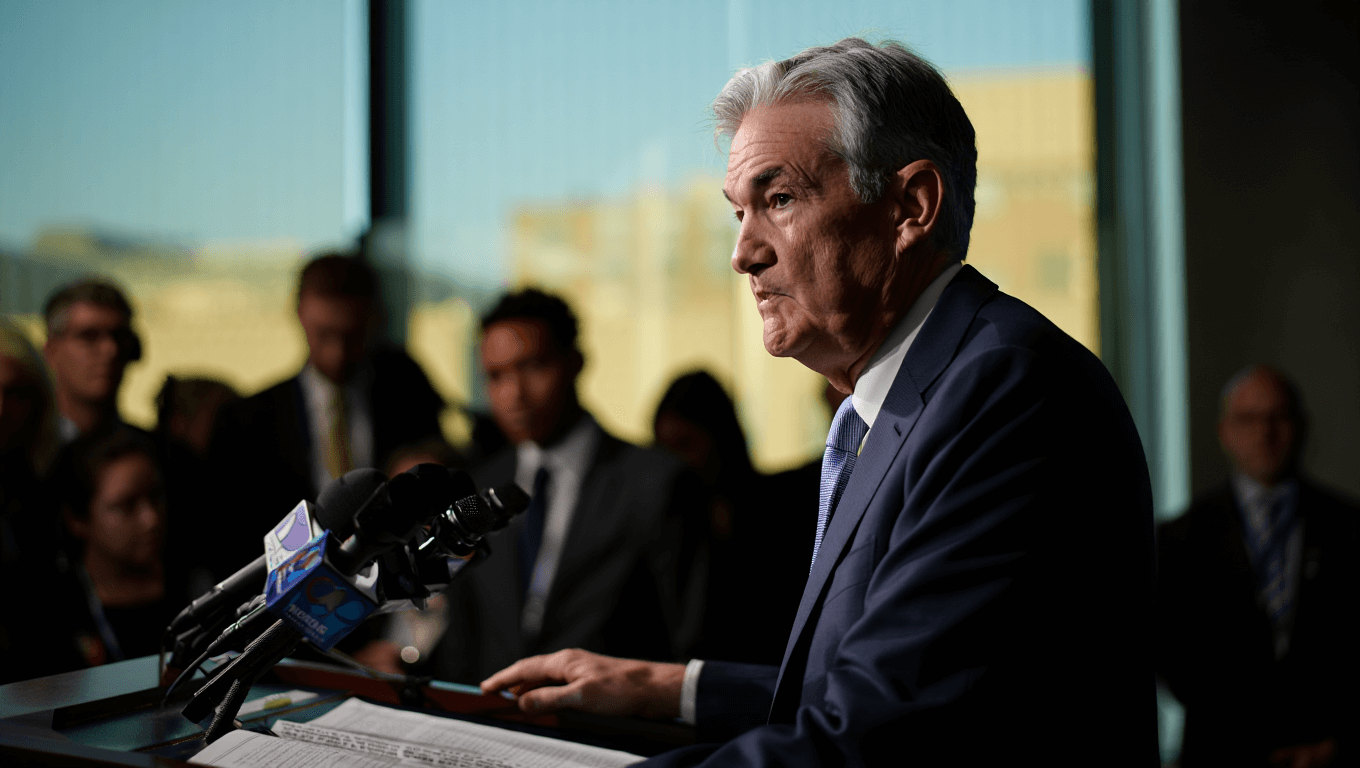

The Federal Reserve is preparing for another pivotal interest rate decision as policymakers confront rising internal disagreements, stale economic data and mounting pressure to stabilize a job market that continues to weaken. Despite inflation remaining stubbornly above the central bank’s target, the Fed is widely expected to approve a third straight quarter-point rate cut. Some describe this as the Federal Reserve’s third rate cut in the current cycle. This move could influence everything from business expansion to consumer credit costs. The upcoming decision has drawn intense attention in financial circles. Investors are tracking market updates through platforms such as Bloomberg and economic insights from institutions like the Brookings Institution. As policymakers navigate the conflicting signals, the Fed’s choice will also shape forecasts for borrowing, lending and broader economic growth heading into next year.

Conflicting Indicators Put Pressure on Fed Officials

Current economic conditions have placed the Federal Reserve in a uniquely difficult position. Inflation in September stood at 2.8%, according to the central bank’s preferred gauge, while unemployment reached 4.4%. In normal circumstances, elevated inflation would justify keeping interest rates steady or even raising them. Yet, the climbing unemployment rate suggests that the job market is under increasing stress. This divergence is crucial as the Federal Reserve considers its third rate cut decision. It creates a sharp split inside the Federal Open Market Committee. Some officials argue that price stability must remain the priority, while others push for lower rates to prevent a broader labor downturn.

The challenge has been compounded by a six-week government shutdown that halted the collection of key data on both inflation and unemployment. With October’s indicators missing and November’s figures delayed until after the vote, policymakers must rely on older data that may no longer reflect real-time economic conditions. Many analysts following labor trends through sources like the U.S. Bureau of Labor Statistics have noted that the absence of updated reports increases the uncertainty surrounding the Fed’s decision. Without current numbers, officials risk either overstimulating the economy by cutting too aggressively. Or they risk tightening conditions at a moment when households and businesses may already be under strain.

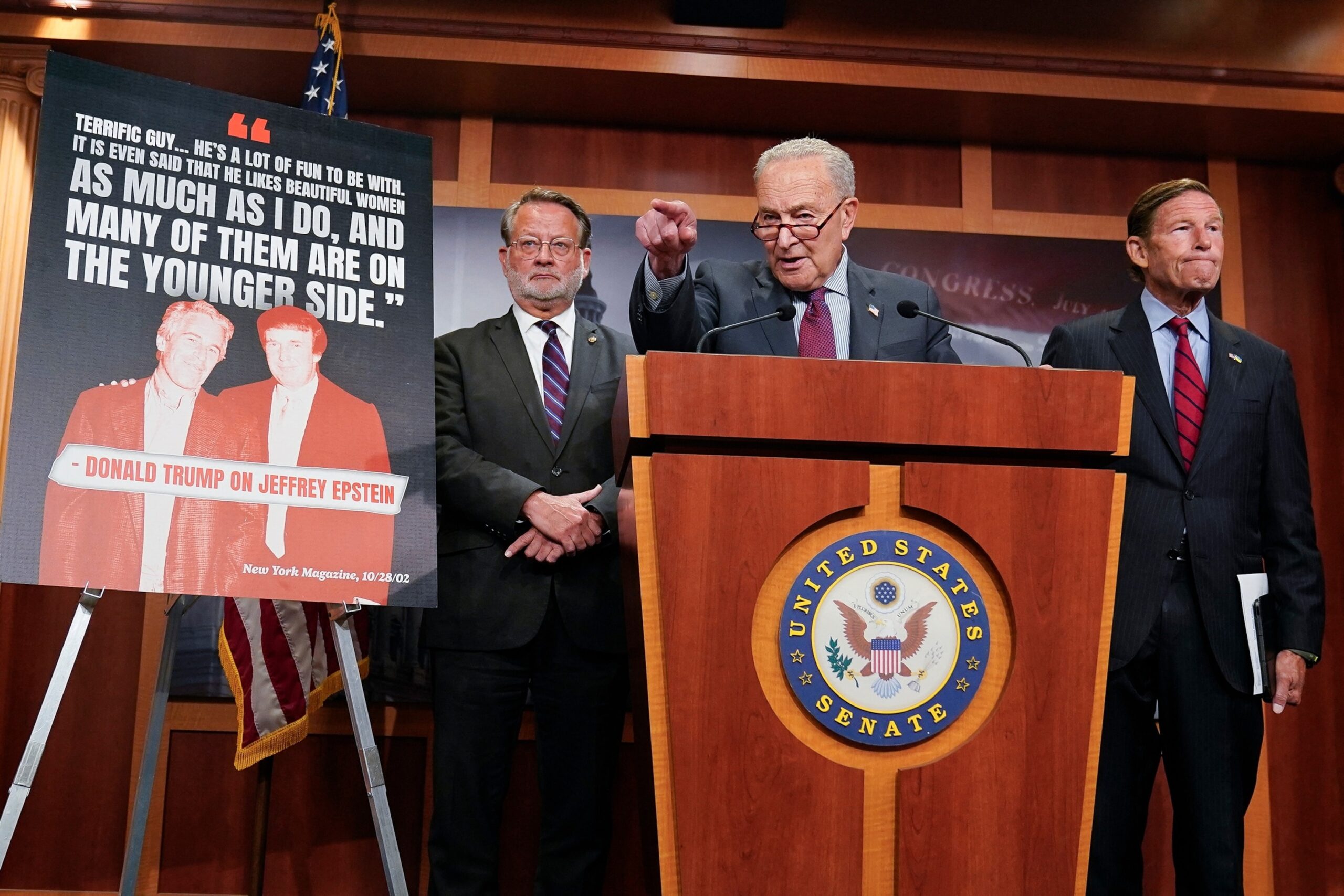

Political Pressure Intensifies as Trump Pushes for Deeper Cuts

The upcoming decision regarding whether the Federal Reserve will make a third rate cut has also been shaped by unusual levels of political pressure. President Donald Trump has openly criticized the central bank’s recent actions, stating that the Fed has acted “too late” in providing relief through rate reductions. His administration has taken steps to influence the direction of monetary policy. This includes appointing White House economic adviser Stephen Miran to the Fed board. Miran has consistently voted for larger half-point rate cuts, marking him as the most aggressive policymaker in favor of easing.

Tensions have risen further as Trump attempts to remove Fed Governor Lisa Cook over unproven mortgage-related accusations, a process currently blocked by the Supreme Court and outlined by legal analysts on platforms such as SCOTUSblog. Despite the central bank’s traditional independence, Trump’s recent statements suggest he expects more rapid action to stimulate the economy, particularly as job market indicators show signs of weakening. Powell’s term as chair expires in May, and the president is expected to nominate a new leader soon. This raises fresh concerns that political dynamics could shape future monetary decisions even more aggressively.

Markets Watch Closely as Investors Brace for Policy Shifts

Investors are preparing for the likelihood of another quarter-point cut, a move that could influence everything from credit card interest to corporate borrowing and home equity loans. Many market watchers have noted that financial institutions such as JPMorgan Chase are already recalculating forecasts for consumer credit demand and corporate lending. The Fed’s last projections indicated an expectation of only one additional cut in 2026. However, those forecasts may shift depending on committee debates and updated economic trends released in the coming months.

A continued pattern of rate cuts would signal that the Federal Reserve is more concerned about rising unemployment than persistent inflation. In contrast, a narrower vote or a surprise hold could reflect growing internal resistance to further easing. Investors remain highly attuned to the Fed’s messaging. They know that small adjustments in interest rates, such as the Federal Reserve’s third rate cut, can influence global markets and strengthen or weaken the dollar. These changes can reshape investment strategies across multiple sectors. With data collection finally set to resume, the central bank will soon regain access to critical information needed for future decisions. But for now, the Fed must make another consequential call using outdated numbers and judgment shaped by deep uncertainty.