U.S.–China Leaders Reinforce Strategic Communication Amid Escalating Global Challenges

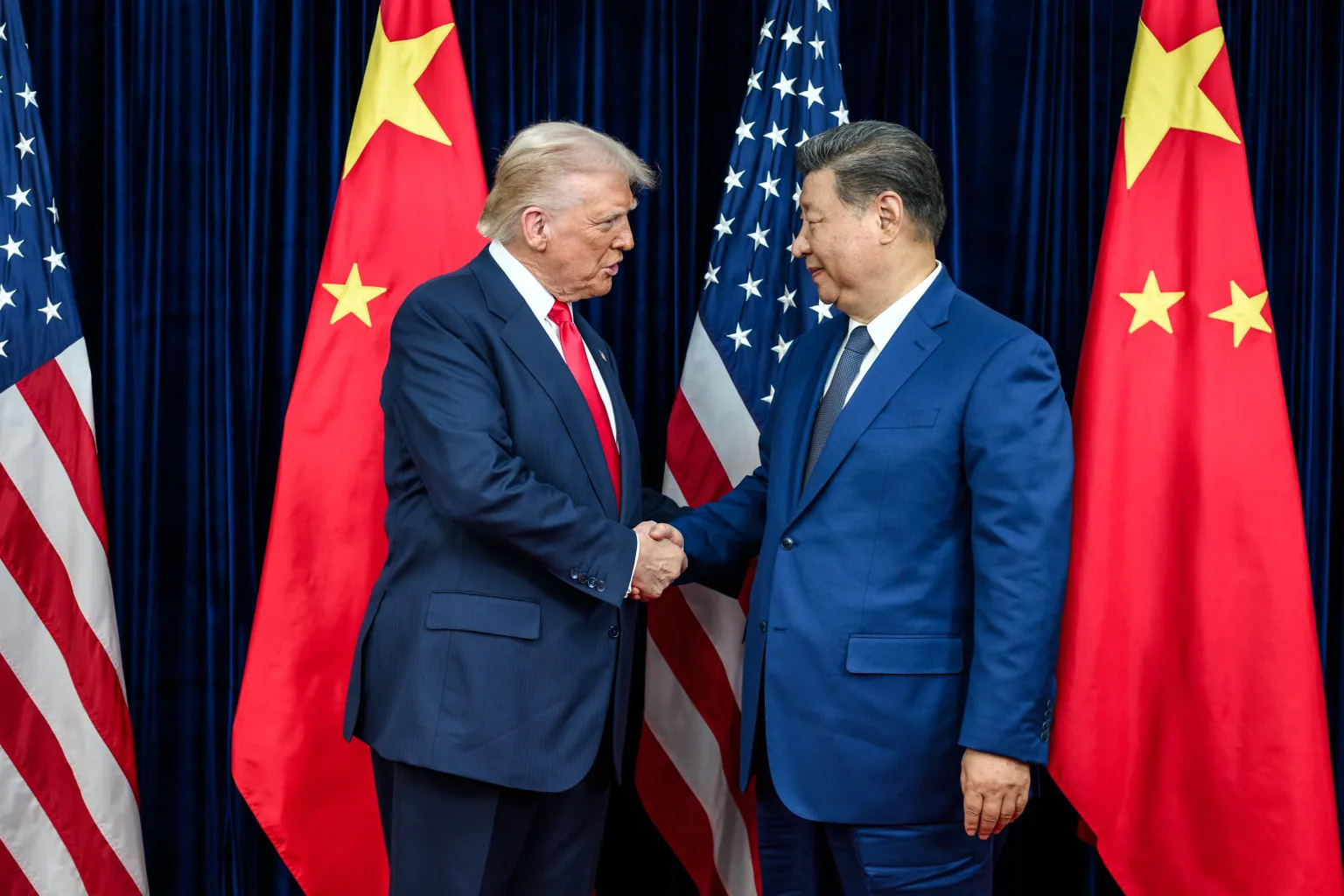

Recently, the Trump–Xi trade and security dialogue was reinvigorated when President Donald Trump and China’s President Xi Jinping held a high-level phone call focused on trade, tariffs, global security tensions, and emerging technological rivalries, marking one of the most significant diplomatic exchanges since the countries began recalibrating their economic relationship earlier this year. The conversation reflected a renewed attempt from both sides to steady a relationship strained by disputes over export controls, supply-chain vulnerabilities, and competing regional interests. Analysts following U.S.–China competition, including global-economy observers within Brookings, have noted that strategic communication between the two powers has become increasingly critical as their economic interdependence intersects with rapidly evolving geopolitical risks.

Trump highlighted that the discussion covered topics ranging from agricultural trade to synthetic opioid flows, emphasizing in a public statement that a strong bilateral relationship remains essential for U.S. farmers, who depend on stable export channels for soybeans and other key commodities. After the U.S. decision to halve one of the tariffs imposed to curb fentanyl-related trafficking, the average duty on Chinese goods remains just below 50%, a level that continues to pressure cross-border manufacturing and retail sectors. China’s government reiterated its desire to “lengthen the list of cooperation and shorten the list of problems,” a line that reflects ongoing efforts to stabilize dialogue even as both countries maneuver within an increasingly competitive global environment. Analysts at Council on Foreign Relations note that such dual-track dynamics—competition paired with selective cooperation—now define the structural reality of U.S.–China relations.

Tariff Reductions, Rare Earth Tensions and Technology Restrictions Shape the Negotiation Landscape

The call followed a series of trade meetings where both nations outlined preliminary frameworks aimed at lowering tensions around tariffs and export controls. In October, negotiators developed a tentative consensus leading the U.S. to withdraw a planned 100% tariff escalation, a move that temporarily eased strain on industries reliant on Chinese manufacturing inputs. China, for its part, paused new export controls covering refined rare earth materials, resources that play a small yet critical role in advanced defense and consumer technologies including semiconductor fabrication, electric vehicles, and aerospace components. Economic policy analysts at institutions such as Peterson Institute for International Economics have repeatedly warned that disruptions to rare earth flows could trigger multi-billion-dollar consequences across global supply chains.

However, the pause remains in effect for only one year, leaving open the possibility that China could restrict shipments in the future as leverage in broader negotiations. Trade experts believe this temporary reprieve gives U.S. industries limited breathing room but does little to resolve structural dependencies that have formed over more than two decades of integrated manufacturing. The conversation between Trump and Xi hinted at the need for deeper engagement on technology governance, export licensing frameworks and the competitive race to secure semiconductor capacity—issues that continue to define the broader economic rivalry between the two countries. Analysts widely expect these matters to dominate diplomatic agendas through the next round of summits, particularly as both governments advance national strategies centered on supply-chain resilience and domestic industrial capacity.

Taiwan, Ukraine and Geopolitical Flashpoints Add High Stakes to the U.S.–China Dialogue

In addition to trade developments, the discussion delved into major geopolitical tensions involving Taiwan, Ukraine and regional alliances across Asia and Europe. Chinese officials reiterated longstanding claims over Taiwan, framing its “return to China” as a central pillar of the post-war international order. Strategic analysts tracking Asia-Pacific security through platforms like RAND Corporation emphasize that Taiwan remains the most sensitive and consequential point of contention between Washington and Beijing, with U.S. commitments to support the island frequently placing both nations at cross-purposes.

The conversation also touched on the situation in Ukraine, where China continues to position itself as a potential mediator while maintaining deep economic ties with Russia, one of its largest energy and commodities partners. At the same time, China remains engaged in a diplomatic standoff with Japan after Tokyo’s newly appointed leadership described a hypothetical invasion of Taiwan as an “existential threat” to Japanese security. China’s response—including restricting some inbound tour groups that contribute billions of dollars annually to Japan’s tourism sector—illustrates how political disputes can rapidly extend into economic retaliation.

Both Trump and Xi underscored the importance of maintaining open lines of communication and accepted mutual invitations for future state visits in Beijing and Washington. With bilateral relations now shaped by tariff battles, competing industrial strategies, the militarization of critical waterways and the reshaping of global alliances, the call represents a renewed effort to prevent geopolitical tensions from spiraling into wider instability. Observers expect subsequent meetings to determine whether the two nations can expand cooperative channels or whether political, military and technological disputes will continue to dominate the world’s most important relationship.