Why Foreign Investors Are Pulling Out of Japan’s Bond Market

Japan’s government bond market has long been one of the most stable fixtures of global finance. However, recent developments suggest a potential Japan bond selloff could be on the horizon due to a BOJ policy shift. It is supported by the Bank of Japan’s ultra-loose monetary policy, negative interest rates, and aggressive yield curve control. This structure allowed foreign investors to rely on Japanese bonds as a steady anchor. Additionally, it served as a source of cheap liquidity for global markets.

However, persistent inflation above the 2% target and rising global interest rates have shifted expectations. This fuels speculation that the Bank of Japan may soon raise interest rates. The speculation has contributed to the Japan bond selloff related to a potential BOJ policy shift. The result has been a dramatic shift in capital flows.

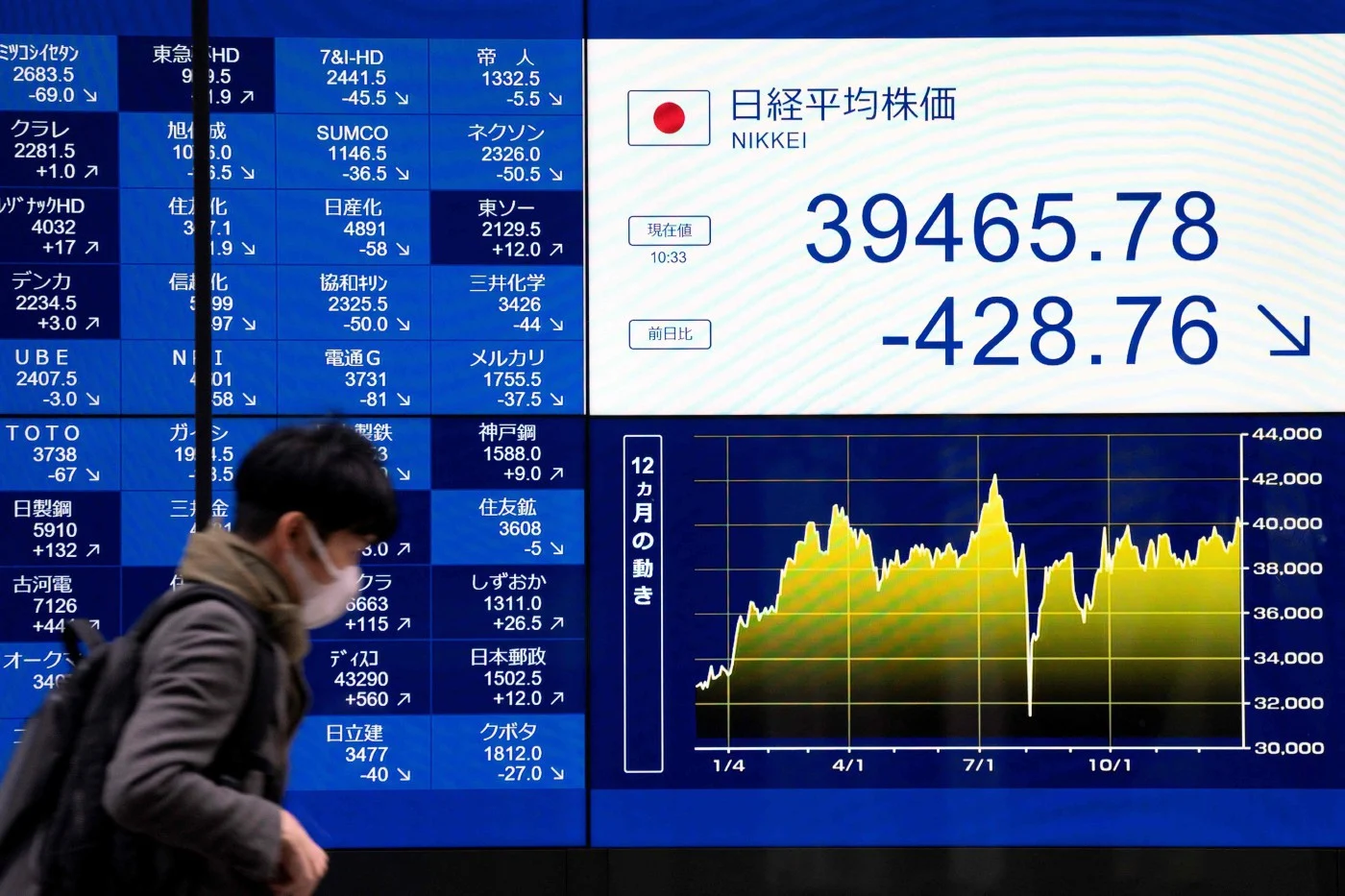

In just one week, foreign investors sold more than 2 trillion yen ($13.6 billion) in long-term Japanese Government Bonds. This marks the largest selloff in a year. The yield on 10-year JGBs climbed to 1.665%. It reached its highest level since 2008, signaling a potential turning point for the bond market. For investors tracking these changes, Bloomberg Markets offers real-time updates on global bond yields and capital flows.

The Ripple Effect on Equities and Global Markets

The sudden selloff in bonds was mirrored in Japan’s equity markets, where foreign investors also reduced their exposure by nearly 1 trillion yen in a single week. This extended their selling streak to three weeks. The broader September outflows reached 4.63 trillion yen, ranking as the third-largest monthly selloff in over a decade.

Domestic investors responded by reducing their own exposure to foreign assets. They pulled 162 billion yen from overseas bonds and sold more than 11 billion yen in foreign equities. These moves suggest that both domestic and international investors are bracing for potential volatility in response to BOJ policy changes.

The possible rate hike, expected as early as the October 30 meeting, would mark Japan’s first significant step toward policy normalization after decades of stimulus. To better understand these global shifts, readers can explore resources from the International Monetary Fund that analyze central bank policies and international capital flows.

The Future of Japan’s Monetary Policy and Investor Sentiment

The weeks ahead are critical for determining whether September’s sharp outflows represent the beginning of a lasting trend or a temporary adjustment. A BOJ decision to raise interest rates could further weaken foreign appetite for Japanese Government Bonds. It could also push yields higher and potentially strengthen the yen. Such a move would also affect global markets, particularly unwinding years of carry trade strategies that relied on Japan’s cheap borrowing environment. On the other hand, delaying monetary tightening risks undermining the BOJ’s credibility in addressing inflation while extending uncertainty for investors. This evolving policy environment may reshape not only Japan’s domestic economy but also its role as a stabilizing force in international finance. Investors looking for guidance on navigating these market changes can access insights from the Bank of Japan. They can also look into global research on OECD for macroeconomic outlooks and policy analysis.