China’s push for semiconductor self-sufficiency has accelerated as US export controls reshape the global chip landscape. State-backed firms are expanding their capabilities in equipment manufacturing, chip design and fabrication. Additionally, policy incentives continue to channel billions of dollars into the sector. When examining China semiconductor industry growth, it is clear that according to data from the Semiconductor Industry Association, China remains one of the world’s largest semiconductor markets. Domestic production is a strategic priority rather than a short-term response.

China’s National Strategy to Build a Self-Reliant Chip Ecosystem

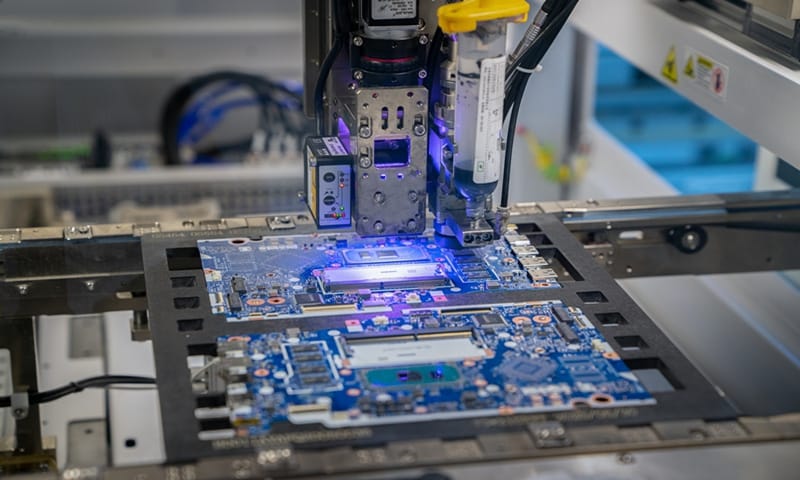

Beijing has intensified investment across the entire semiconductor supply chain, from materials to advanced manufacturing tools. Government funds and provincial incentives aim to reduce reliance on foreign suppliers, especially in areas constrained by US trade rules. Institutions such as the Ministry of Industry and Information Technology play a central role in coordinating policy. These institutions align industrial planning with national security goals and long-term economic growth.

Local companies are increasingly focusing on developing alternatives to restricted technologies. These include lithography components, deposition equipment and advanced packaging solutions. While performance gaps remain at the cutting edge, the emphasis has shifted toward scalability, reliability and domestic integration. Immediate parity with foreign leaders is not the current focus.

Export Controls Reshape Global Semiconductor Competition

US restrictions on advanced chips and manufacturing equipment have altered supply chains worldwide. Analysts tracking global markets through platforms like Statista note that China’s semiconductor imports still represent hundreds of billions of dollars annually. This underscores both its current dependence and the scale of opportunity for domestic firms.

At the same time, partial easing of restrictions on certain high-performance chips has introduced uncertainty. Chinese policymakers view these shifts cautiously and reinforce the belief that long-term competitiveness depends on local innovation. Access to external suppliers is not the main solution. This approach mirrors earlier industrial strategies in aerospace, telecommunications and renewable energy.

Innovation, Investment and the Long Road Ahead

Despite rapid progress, challenges remain in advanced chip fabrication. This is particularly true at smaller process nodes used for artificial intelligence and high-performance computing. Reports from McKinsey & Company highlight that semiconductor self-sufficiency is a multi-decade effort. It requires sustained capital investment, specialized talent and deep collaboration between industry and academia.

Chinese firms are responding by rethinking development models and prioritizing original engineering over replication. As export controls persist, the semiconductor sector is becoming a proving ground for China’s broader ambition to compete technologically on its own terms. This is reshaping the balance of power in the global chip industry.