Crucial chokepoint faces renewed scrutiny amid Israel-Iran conflict

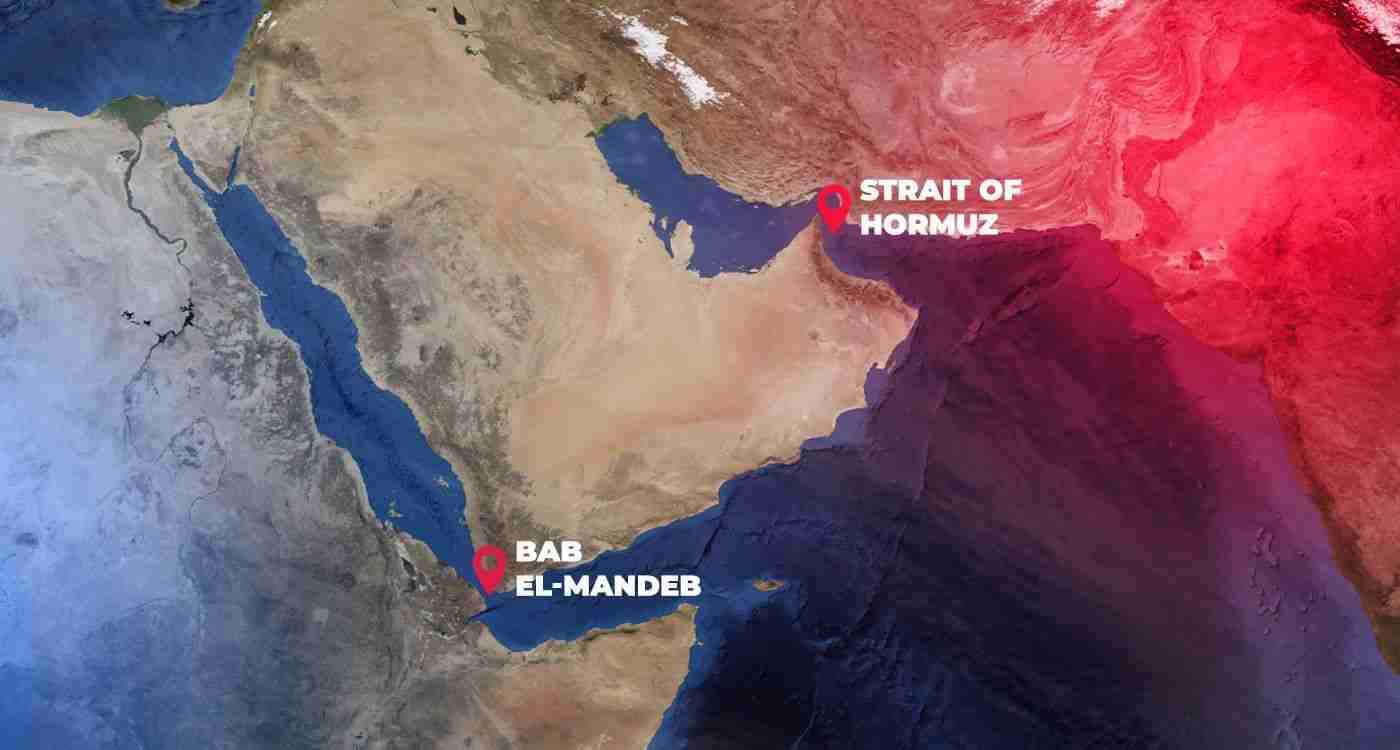

Tensions between Israel and Iran are once again drawing international attention to the Strait of Hormuz, a narrow maritime passage critical to global oil transportation. Experts warn that escalating hostilities could jeopardize commercial shipping, especially in a region responsible for nearly a fifth of the world’s daily crude supply.

Why Hormuz Matters to Global Energy

Located between Iran and Oman, the Strait of Hormuz links the Persian Gulf with the Gulf of Oman and the Arabian Sea. At its narrowest point, the strait is only 33 kilometers wide, with designated shipping lanes just over 3 kilometers in each direction. This makes it a strategic vulnerability for global energy flows.

According to energy transit data, around 20 million barrels of crude and refined fuels pass through the strait daily. Qatar, a top global exporter of liquefied natural gas (LNG), relies heavily on this passage for its outbound shipments.

Current Risks and Shipping Disruptions

Though no major incidents have yet occurred in the strait since the Israel-Iran conflict escalated, maritime carriers are increasingly cautious. Some vessels have increased onboard security, while others have rerouted to avoid the area.

Recent reports cite rising instances of electronic interference affecting commercial ship navigation in both the strait and wider Gulf region. With no immediate resolution in sight, freight costs have surged. Tanker rates for shipments from the Middle East to East Africa and East Asia have climbed by more than 20% in some cases.

Asia Faces Highest Exposure to Supply Shocks

The U.S. Energy Information Administration (EIA) estimates that more than 80% of oil and fuel transiting the Strait of Hormuz is destined for Asian markets. China, India, Japan, and South Korea collectively account for nearly 70% of that flow, making them particularly vulnerable to disruptions.

Strategic Dilemma for Iran and Gulf States

If Iran chooses to block the strait, it may provoke a U.S. military response, as the U.S. Fifth Fleet, based in Bahrain, is tasked with safeguarding maritime trade in the region. Such a move would also strain Iran’s ties with Arab Gulf nations like Saudi Arabia and the United Arab Emirates, which depend on uninterrupted oil exports.

Furthermore, Iran’s own economy relies on using Hormuz to export its oil, particularly to China. Analysts argue that any closure would be a self-defeating move for Tehran.

Existing Alternatives and Infrastructure

To mitigate reliance on the strait, Gulf countries have developed alternative routes. Saudi Arabia operates the East-West Pipeline, capable of transporting 5 million barrels daily to the Red Sea. The UAE also maintains a pipeline that connects inland oil fields to its Fujairah export terminal on the Gulf of Oman.

Estimates suggest that roughly 2.6 million barrels per day could bypass the strait through these alternate channels if needed.

Outlook Remains Uncertain

As the geopolitical standoff continues, markets and governments remain on high alert. Any escalation that threatens the Strait of Hormuz would reverberate far beyond the Middle East, raising energy costs globally and reshaping strategic alliances.