Open enrollment under the Affordable Care Act is unfolding against a backdrop of legislative indecision. This backdrop is reshaping consumer behavior and intensifying anxiety about health insurance affordability. Millions of Americans are making coverage choices without clarity on whether enhanced premium subsidies will continue. This situation has injected hesitation into the market and complicated planning for households already navigating rising living costs. The uncertainty is not abstract. It directly affects monthly budgets, plan selection, and the willingness of new enrollees to commit to coverage during the enrollment window.

The enhanced subsidies, originally expanded during the pandemic, significantly reduced the share of household income required to pay for premiums. They also removed income caps for eligibility. As Congress debates whether to extend these measures, consumers are confronting potential premium increases that can reach thousands of dollars annually. Federal guidance on enrollment timelines and eligibility rules remains available through https://www.healthcare.gov. Yet, shoppers increasingly report that the lack of policy certainty makes it difficult to finalize decisions with confidence.

Rising premiums, delayed decisions, and consumer behavior shifts

The prospect of higher premiums has led many ACA shoppers to pause or delay enrollment. This is particularly true for those most affected by the expiration of enhanced subsidies. For middle-income households, the return to pre-pandemic subsidy formulas could mean paying a significantly higher percentage of income toward monthly premiums. Some families face increases exceeding $10,000 per year in total health care spending when deductibles and copays are included.

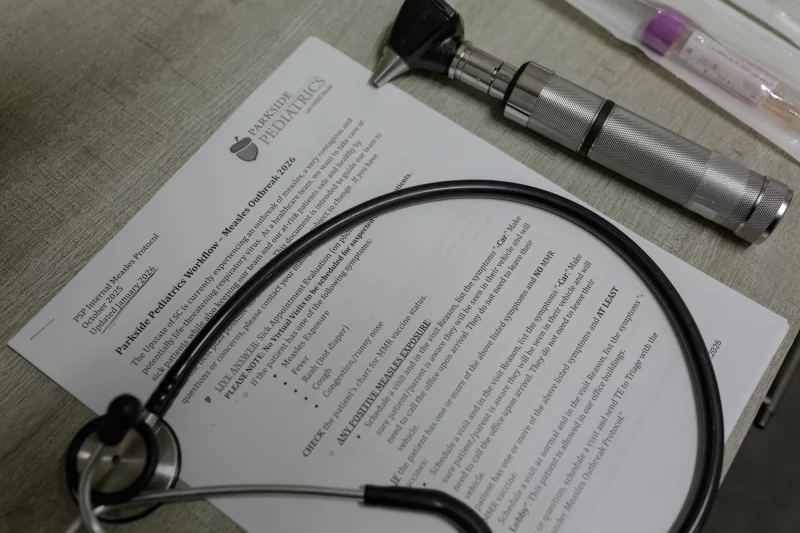

This uncertainty is influencing how consumers approach plan selection. Many returning enrollees are acting earlier to lock in coverage they already understand. Meanwhile, first-time shoppers appear more cautious. State-based marketplaces report noticeable shifts toward lower-premium bronze plans. These plans reduce monthly costs but expose consumers to higher deductibles that can surpass $7,000 before coverage meaningfully begins. Policy analysts tracking these trends emphasize that affordability pressures often push consumers toward plans less protective in the event of a serious illness.

Marketplaces must also prepare for rapid operational changes should Congress act late in the enrollment cycle. Updating premium calculations, revising eligibility notices, and communicating changes to consumers can take weeks. State-run exchanges such as https://www.coveredca.com acknowledge the operational strain created by late legislative action. They note that contingency planning has become a routine but costly necessity during periods of political gridlock.

Political gridlock and its impact on state marketplaces

The ongoing debate in Congress reflects deeper divisions over the future of the Affordable Care Act itself. While some lawmakers argue that extending enhanced subsidies is essential, others question the long-term cost and policy implications of maintaining broader eligibility. The result is a stalemate that leaves states, insurers, and consumers in a holding pattern during one of the most critical periods of the health insurance calendar.

State marketplaces play a central role in absorbing the shock of federal inaction. Many are responsible for running outreach campaigns, managing call centers, and automatically reenrolling existing customers. When subsidy rules are uncertain, systems must pivot quickly, often at additional administrative cost. Oversight of marketplace operations and funding mechanisms is detailed through congressional resources at https://www.aph.gov, where legislative activity related to health policy and budget decisions continues to evolve.

The political implications extend beyond policy mechanics. Surveys consistently show that health care affordability is a decisive issue for voters. This is particularly true when premium increases exceed $1,000 annually. Lawmakers are acutely aware that decisions made—or avoided—during open enrollment can influence public sentiment heading into election cycles. This is especially among moderate voters who rely on ACA coverage without qualifying for other public programs.

Affordability pressures and long-term implications for coverage

If enhanced subsidies lapse, the affordability landscape of the ACA will change markedly. Lower-income enrollees would once again be required to contribute a minimum percentage of their income toward premiums. Meanwhile, households earning above four times the federal poverty level would lose eligibility entirely. For older adults not yet eligible for Medicare, this shift can be especially severe, as age-based premium calculations already push monthly costs higher.

Insurers, meanwhile, must price plans amid uncertainty about the risk pool. If healthier consumers opt out due to cost concerns, premiums can rise further, creating a feedback loop that undermines market stability. Health policy experts warn that even a temporary lapse in subsidies could have lasting effects on enrollment patterns and insurer participation. Broader analysis of insurance market dynamics and consumer cost exposure is regularly published by research organizations such as https://www.kff.org, which track enrollment, premiums, and subsidy impacts nationwide.

For many families, the decision to maintain ACA coverage despite higher costs reflects necessity rather than choice. Chronic conditions, ongoing treatments, and lack of affordable employer-sponsored insurance leave few alternatives. As open enrollment continues, the absence of clear legislative direction remains a defining feature of the current cycle. This shapes not only immediate enrollment numbers but also long-term perceptions of the ACA’s reliability as a cornerstone of the U.S. health care system.

In this environment, the stakes extend well beyond a single enrollment season. The outcome of the subsidy debate will influence household finances, state marketplace operations, and the broader trajectory of health coverage in the United States. Until clarity emerges, ACA shoppers are left balancing risk, cost, and necessity in a system defined as much by political uncertainty as by policy design.